August 3, 2023

Despite actions taken by the Fed to cool the economy and quell inflation, the economy has remained more vibrant than expected. Whether this has been the start of a new secular bull market or is simply a relatively long bear market rally initially supported by $Trillions in COVID economic stimulus and later supported by a serious market rally narrowly focused on the primary AI technology companies.

It is difficult to begin a recession without pessimism. That said, the current AI optimism may soon fade as reality sets in that it may still be another decade before AI bots are fully designed, trained, and employed in numbers sufficient to measurably improve productivity and bottom-line earnings.

JPMorgan strategist Marko Kolanovic recently noted, “While the economy’s recent resilience may delay the onset of a recession, we believe that most of the lagged effects of the past year’s monetary tightening have yet to be felt, and ultimately a recession will likely be necessary to return inflation to target.”

The market dip this week was triggered when Fitch Ratings lowered its US debt rating from AAA to AA+ citing “the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance over the last two decades.” They clearly didn’t get the AI optimism memo.

Will current AI optimism persist long enough to soften the anticipated lagged effects of monetary tightening and result in the desired soft landing? Or, will the current AI bubble burst, frighten investors, and lead to capitulation selling on the way to a hard landing? Perhaps the operative question should be “Can the Fed employ its monetary tools to successfully herd a population of boom-bust-minded creatures?”

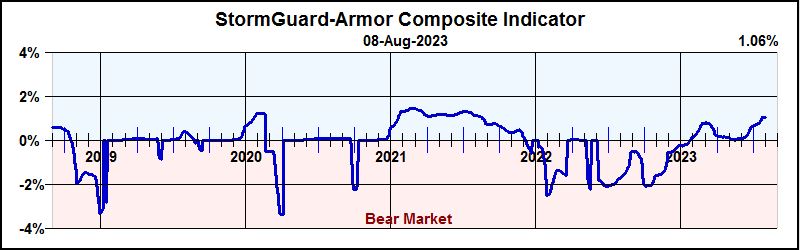

StormGuardTM Reflects Bull Reality

StormGuard doesn’t say what investors should do, but rather reflects what investors are already doing, and hopefully will continue to do. We may be in a new secular bull market or simply in an extended bear market rally. StormGuard’s job is to help minimize the time spent on the wrong side of the trade. Short of an economic bombshell, the market will focus on quarterly earnings reports to judge the arrival of the long-anticipated recession.

StormGuard Rises During Bull Run

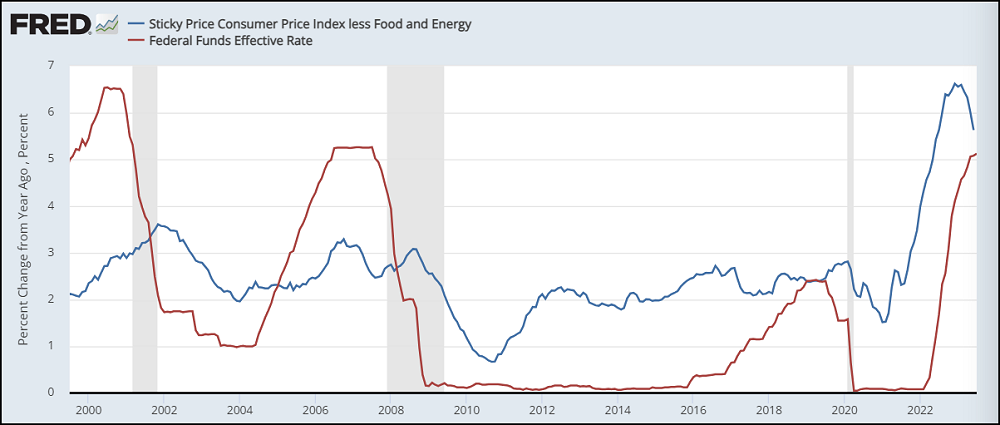

Interest Rates vs. Sticky Inflation

“Sticky Inflation” rose sharply in the wake of the post-COVID $Trillions of economic stimulus provided by the Fed and Congress. The Fed responded by sharply raising interest rates to put a damper on the inflationary economy. Some economists have suggested that in past periods, inflation was never quelled without raising interest rates above the rate of inflation. Interest rates are still short of that mark.

Interest Rates vs. Sticky Inflation

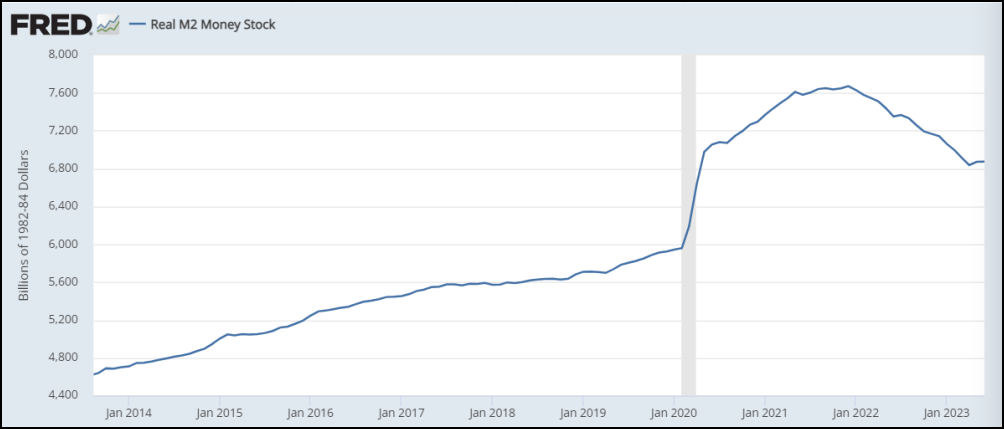

M2 Money Supply Progress

The M2 Money Supply is the available spending money of individuals and companies. Immediately following the Covid Crash the money supply was increased by multiple $Trillions and resulted in inflation (too many dollars chasing too few goods). The Fed had been working on reducing the money supply to be in line with the former trend. It appears that they have halted their “quantitative tightening” and will see if things settle out.

M2 Money Supply No Longer Decreasing

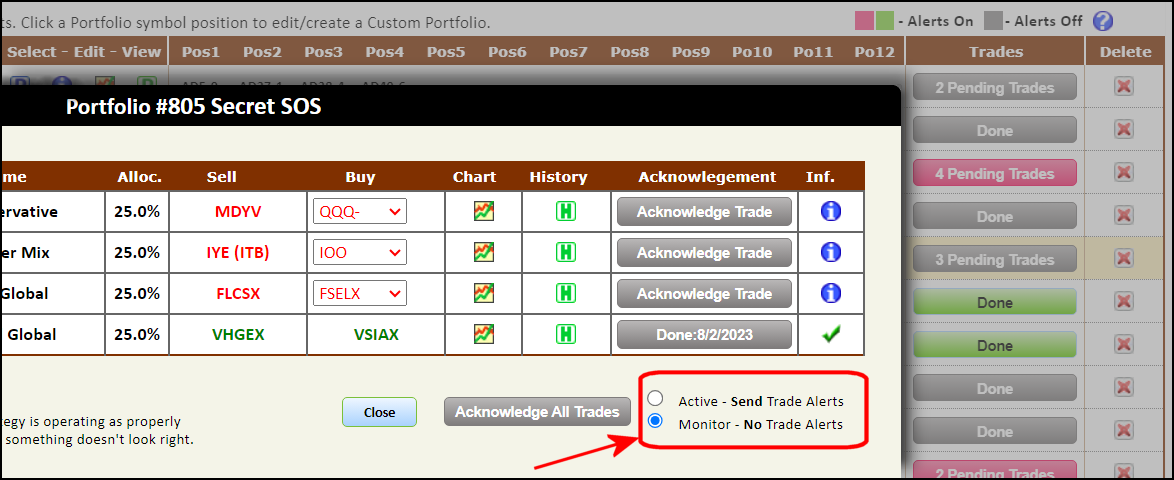

INTRODUCING: AlphaDroid Trade Alert ON / OFF Control

All AlphaDroid Portfolios now have individual Trade Alert ON/OFF controls built into their Trade Acknowledge popup windows. Previously, Trade Alerts were sent for all Portfolios – even if you only wanted to monitor it but not actively trade it. If you do not wish to receive Trade Alerts for a monitored Portfolio, open its Trade Acknowledge popup window (as illustrated below) and select the “Monitor – No Trade Alerts” option. This will change all of its Acknowledge Trade buttons to gray indicating that their Trade Alerts are now disabled. All other functionality will remain the same. Any newly imported Portfolio will be in “Monitor” mode by default – but a simple click of the “Active” option button will enable the Portfolio to actively send trade alerts.

Patience, not panic! Rules, not emotion!

May the markets be with us,

Disclaimers:

Investing involves risk. Principal loss is possible. A momentum strategy is not a guarantee of future performance. Nothing contained within this newsletter should be construed as an offer to sell or the solicitation of an offer to buy any security. Technical analysis and commentary are for general information only and do not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of any individual. Before investing, carefully consider a fund’s investment objectives, risks, charges and expenses, and possibly seeking professional advice. Obtain a prospectus containing this and other important fund information and read it carefully. SumGrowth Strategies is a Signal Provider for its SectorSurfer and AlphaDroid subscription services and is an Index Provider for funds sponsored by Merlyn.AI Corporation. SumGrowth Strategies provides no personalized financial investment advice specific to anyone’s life situation, and is not a registered investment advisor.